NEWTON COUNTY – The Newton County Board of Education (BOE) rolled out its organizational priorities for the 2025-26 school year on Tuesday night.

Special Assistant to the Superintendent Benjamin Roundtree presented the four organizational priorities to the public:

- Advancing academics, school improvement and student supports

- Advancing operational effectiveness

- Advancing culture and engagement

- Advancing innovation and organizational stability

During the presentation, Roundtree explained that the first category, previously labeled “academics,” was modified to include “school improvement and student supports.” This addition supports the board’s effort to improve student performance by starting in the classroom.

“As has been emphasized many times, our work centers on improving student performance,” Roundtree said. “...However, the very core of improved student achievement begins in the classroom, where rigorous, high-quality, and standards-aligned instruction must happen every day, in every school and for every child.”

In a press conference with local media outlets earlier that day, Superintendent Dr. Duke Bradley III emphasized the importance of this addition, calling the change “nuanced but critical.”

Advancing Academics, School Improvement and Student Supports

Roundtree highlighted two main initiatives under this priority:

- Strengthening the district’s literacy foundation, which involves clarifying and documenting our approach to literacy improvement, aligned to research-based practices and supported by research-based, high quality resources.

- Strengthening the instructional core, which includes ensuring the consistent implementation of high-quality, Tier 1 instruction across all classrooms through evidence-based practices, interventions, and systemic supports.

Roundtree says these academic focus areas go hand-in-hand with one another. This school year, Newton County is focusing on implementing instructional models across the district that are better suited for students' needs.

“To that end, you will note that this year’s academic priorities are focused – not on a proliferation of new initiatives, but on deepening and scaling improvement strategies that work,” Roundtree said. “We are going narrow and deep, rather than broad and shallow.”

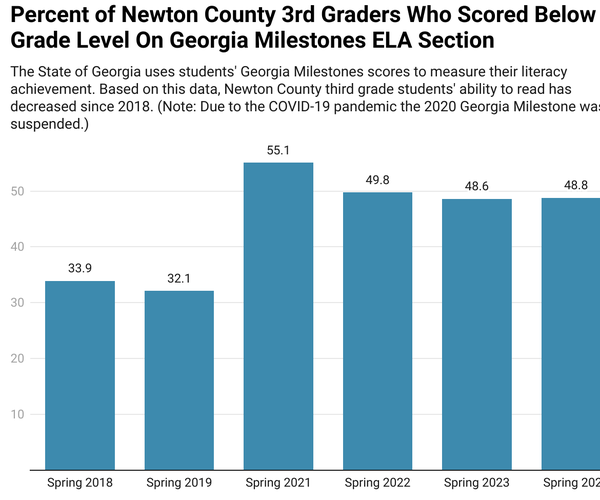

During the press conference, Bradley noted the district has made strides to strengthen student literacy. In doing so, the board has worked to clarify and document the district’s literacy improvement philosophy, strategy and the corresponding resources.

“We recognize that literacy is the foundation of all learning,” Bradley said. “And as a school district, we’ve got to make measured improvement in that regard.”

To comply with Georgia law, Newton County set out to train all of its early childhood education teachers in the “science of reading” last year. The district partnered with the Newton Education Foundation to implement Reading is Essential for All People (REAP) into two elementary schools, Mansfield Elementary School and East Newton Elementary School.

Through implementing REAP, 97% of kindergarten and first grade teachers at Mansfield and East Newton were trained in the “science of reading.” This year, Newton County plans to expand REAP to six schools and start training secondary teachers in this curriculum.

Chief of Learning and Leadership Tracy Blackburn says the district’s ability to expand REAP into all schools is based on the availability of funds through the Newton Education Foundation. In addition, the district will determine whether to keep expanding REAP into more schools once it receives comprehensive data from the schools already using the program.

In regard to strengthening the instructional core, Bradley details the board’s new balanced assessment system. This system aims to provide teachers across the district with “standardized best practices.”

“We have common expectations for what we want teaching and learning to look like,” Bradley said. “Common expectations for how we respond when kids don’t get it and common expectations for what we do with the data when we get it.”

Blackburn doubles down on this and explains that the district will be implementing a “balanced assessment system.” This system will standardize assessments across all schools, which will make it easier to look at data obtained from students’ learning.

In addition, Blackburn says the board will be implementing a "systematic way of doing intervention.” This way, it is not left up to the teacher to figure out how to teach a student who may be struggling with mastering the content more than their peers.

“It shouldn’t matter who’s classroom a child walks into,” Blackburn said. “They’ll have that same experience.”

Starting this school year, teachers will be receiving training from an intervention manual in order to inform them on what these systems will look like.

Advancing Operational Effectiveness

The second organizational priority has four bullets:

- Advance school safety through coordinated improvement strategy.

- Ensure development of a multi-year strategic plan.

- Identify and implement necessary operational efficiencies to streamline core systems and enhance organizational effectiveness.

- Evaluate district-wide facilities to explore opportunities for future use, right sizing, efficiency, upgrades, and modernization.

Roundtree highlighted one strategy that was deployed as a pilot program: Weapons detection technology. In the coming months, the district will discuss whether or not to implement this system permanently.

During the press conference, Chief Operations Officer Dr. Michael Barr said the board has prioritized a layered approach to school safety. These layers include four key components: (1) People, plans and procedures, (2) infrastructure and investment, (3) student code of conduct and (4) mental health support.

Barr also said that while preparedness is important, the goal is prevention. Accordingly, one of the district’s pursuits this year is to obtain the Ready Georgia Seal of Preparedness.

“That’s a statewide recognition that reflects a commitment to school safety and planning,” Barr said. “And it requires our schools to meet rigorous standards.”

Barr says much of what needs to be done to obtain this seal will be behind the scenes, like comprehensive safety planning and performing safety audits of Newton County Schools.

Bradley says implementing necessary operational efficiencies is unseen work. For example, last year the board added new benefits to employment packages. Bradley says this is important in order to remain a competitive workplace and retain teachers.

“When we don’t keep our people, we’re obviously starting over and over and over and reinvesting and reinvesting and that’s just not efficient,” Bradley said.

Evaluating district-wide facilities is all about providing resources to the evolving needs of parents and children in the Newton County School System.

“How do we provide an array of resources for families that may not speak English?” Bradley said. “How do we create, maybe, a welcome center or a dual enrollment depot?

“...It’s gotta’ be more than simply sending our communication in English and Spanish, right?” Bradley said. “We’ve got to do a much better job of probing the kinds of things that we know all of our parents and families need or want.”

Advancing Culture and Engagement

The third organizational priority includes two initiatives:

- Develop a commonly applied, Tier 1 behavior support and intervention framework.

- Deepen community and stakeholder engagement.

Roundtree emphasized the school district’s responsibility to create supportive environments in which students can learn and grow.

In reference to deepening community and stakeholder engagement, Roundtree announced that the school system will be launching a comprehensive Stakeholder Engagement effort called “Community Conversations.”

“These convenings will allow us to hear more about how our school district may better meet the needs and expectations of our parents and families,” Roundtree said.

A common theme throughout each organizational priority is standardizing across the district. That theme remains true under advancing culture and engagement, particularly in relation to addressing behavioral issues.

During the press conference, Chief Strategy and Support Services Officer Dr. Shelia Thomas explained what this would look like.

Thomas says the district will implement common student behaviour expectations, as well as look at students’ well-being, as success is grounded in emotional stability. This year, the district plans to provide clarity on what support systems are already in place for students’ mental health.

Advancing Innovation and Organizational Stability

The last organizational priority includes three points:

Strengthen pathways and programs for students that support workforce development, aligned with community needs and industry partnerships.

Evaluate and modernize policies to promote coherence and to correspond with the current state of the district.

Invest in the professional growth of current and aspiring leaders to strengthen executive capacity, develop a sustainable leadership pipeline, and ensure high-impact leadership at all levels.

Roundtree explains to the public that this last organizational priority is not just about preparing students for jobs but, “building a talent pipeline” of students who are ready to “compete and thrive.”

During the press conference, Executive Director for School Leadership Dr. Shannon Buff said Newton County Schools will now offer dual enrollment classes embedded into every high school.

To advance workforce development throughout the community, the district is rolling out a K-12 framework.

“In kindergarten through fifth grade, they get exposure to [the] workforce and in sixth through eighth grade they get to explore and in ninth through 12th they get to experience [the] workforce,” Buff said.

BOE Discussion

District 5 BOE member Shakila Henderson-Baker was the only board member who commented on the district’s organizational priorities. She started out by highlighting some of the words Roundtree used in his presentation such as, “right, necessary, and urgent” in order to inform her comments.

Noting confusion, Henderson-Baker requested a separate presentation for board members regarding what framework will be used to strengthen the instructional core.

She said in the past it was customary to inform the board of new standards being implemented into the upcoming school year.

“I want to make sure I’m doing my due diligence as a board member and being accountable to the mission, which is educational excellence for all students,” Henderson-Baker said.

Henderson-Baker also emphasizes her support for developing a strategic plan. She mentions if students and parents check the BOE website, the last strategic plan was rolled out in 2018.

“So it was developed pre-pandemic, before this district became one-to-one in gathered devices, Henderson-Baker said. “Before demographics and socioeconomic status of students that we serve changed in the district, before a lot of things started rolling out, before education by itself started changing.”